By Angela Huffman

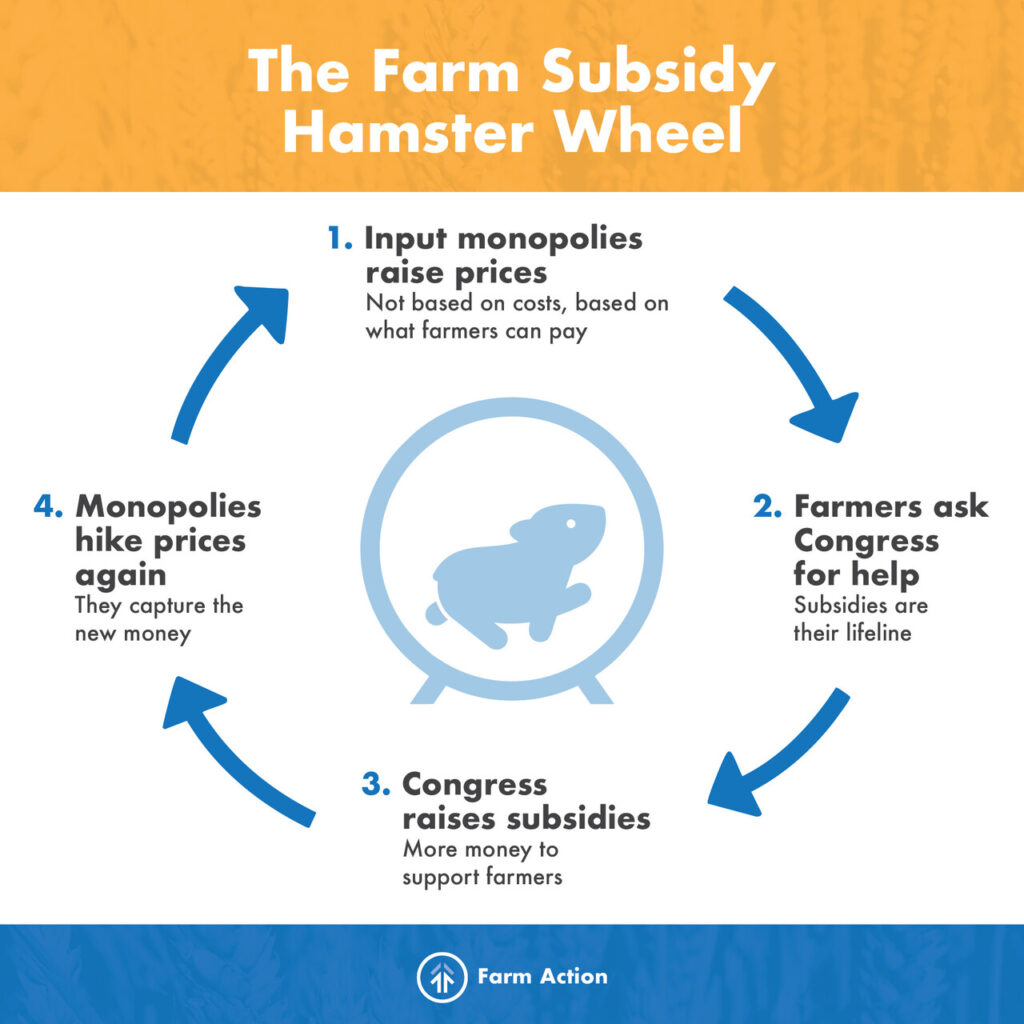

The farm safety net was meant to protect farmers from volatile markets and unpredictable weather. But powerful corporations have turned it into something very different: a hamster wheel that keeps farmers stuck no matter how hard they run.

Here’s how the cycle works: input giants like fertilizer, seed, and chemical companies raise their prices—not based on production costs or supply and demand, but on what they know farmers can pay. With costs climbing, farmers are forced to turn to Congress for help just to stay afloat. Lawmakers respond by raising subsidies through programs like crop insurance or Price Loss Coverage, hoping to throw farmers a lifeline. But as soon as the money is available, these companies raise prices again, capturing the new funds for themselves. The cycle repeats, turning taxpayer dollars meant to support farmers into guaranteed corporate profits.

A Rigged Pricing System

Most people assume prices rise and fall with supply and demand. But in agriculture, the largest input suppliers play by a different set of rules.

One of the nation’s biggest nitrogen fertilizer companies admitted that about half of fertilizer price changes are tied to grain prices. In other words, when farmers earn more—whether from higher crop prices or new subsidies—fertilizer companies raise prices to capture it.

This rigged pricing system turns taxpayer dollars meant for farmers into guaranteed corporate profits. Farmers remain trapped, their margins squeezed no matter how much aid is provided.

Who Really Wins?

Corporations walk away with the profits while farmers and taxpayers are left behind:

- Farmers: Subsidies come in, but rising input costs eat them away. The promised relief never arrives.

- Taxpayers: Billions are spent on subsidies, but much of it doesn’t reach family farmers.

- Agribusiness giants: Fertilizer, seed, and chemical companies—already highly concentrated and powerful—capture more profit with every round of government support.

When Good Programs Go Wrong

Programs like crop insurance and reference price guarantees were meant to stabilize farmers and ensure a reliable food supply. But over time, they’ve been bent to serve the largest operations:

- The top 10% of farms receive more than three-quarters of commodity payments.

- Just 2% of farms captured more than one-third of crop insurance subsidies in a single year.

- Young and beginning farmers are often excluded because payments are tied to “base acres” that only larger, established farms control.

Instead of protecting farmers, these programs too often fuel the subsidy cycle—reinforcing a system where corporations, not farmers, come out on top.

Getting Farmers Off the Wheel

If taxpayer dollars are going to truly support farmers and rural communities, we need reforms that break the cycle of corporate capture. That means:

- Reforming crop insurance so it works for small and mid-sized farms, not just the largest.

- Ending subsidy hikes that pad corporate profits instead of helping farmers.

- Enforcing antitrust laws to rein in consolidation in seed, fertilizer, and chemicals.

- Expanding safety net access for young, beginning, and underserved farmers.

- Tying subsidies to stewardship so that farmers are rewarded for building healthy soil and resilient food systems.

The Bottom Line

The farm safety net was meant to protect farmers. But corporate power has twisted it into a system that drains public dollars while leaving farmers stuck.

Farmers don’t want endless subsidies. They want a fair chance to make a living from their hard work. It’s time to build a safety net that actually protects farmers, not the companies that profit off them.