In the last three posts of our Food Monopoly Files series, we’ve traced how monopoly agriculture captured our food system—from its historical rise, to the Big Four’s stranglehold over meatpacking, to the seed and pesticide giants that have trapped farmers from the ground up. Now, we turn to another critical supply that many farmers have come to rely on: fertilizer—the foundation for growing most of our major crops.

And here, too, a handful of corporations call the shots.

Three Corporations, Total Control

Synthetic fertilizers have long been marketed as the key to boosting yields, but they’ve also become a profit engine for a handful of global corporations. Today, just three companies—Nutrien, Mosaic, and CF Industries—control most of the North American fertilizer market. With so few players in the market, these giants wield near-total control over supply and prices.

To make matters worse, fertilizer isn’t just about farming. Because it underpins the production of so many crops, price spikes ripple across the entire food system.

Suspicious Price Spikes

In 2021, fertilizer prices began to soar—even as production costs remained stable. Farmers were told that rising natural gas prices and supply chain issues were to blame. But Farm Action’s research told a different story.

Our 2022 report found that fertilizer corporations used global disruptions as cover to artificially inflate prices and pad their profits. The data showed that while natural gas costs increased only modestly, fertilizer prices spiked by more than 100%, and corporate profits jumped by nearly 300% over the same period.

These companies weren’t struggling—they were thriving. Nutrien, Mosaic, and CF Industries all reported record profits and shareholder payouts during the spike, confirming what many suspected all along: The price hikes had little to do with real costs and everything to do with market power.

Farmers were caught in the middle, paying two or three times more for the same supplies, while fertilizer executives cheered “favorable pricing environments” on earnings calls. The result? Billions siphoned from rural communities straight into corporate coffers.

Trapped With No Options

Today, many farmers are trapped in a system that leaves them with no real choices. Farm support programs, infrastructure, and markets are all structured to incentivize practices that keep farmers on what we call the ‘industrial agriculture treadmill’—a system that keeps them dependent on costly supplies and narrow production models.. This system—built and reinforced by corporate interests—has made the use of synthetic fertilizer the norm for most.

When fertilizer prices spike, farmers can’t simply charge more for their crops. Most have no control over the prices they’re paid, which are set by powerful buyers in highly consolidated commodity markets. That means every increase in input costs cuts directly into their bottom line.

This imbalance has sparked repeated calls for federal bailouts to bring relief to farmers struggling with soaring input costs and low commodity prices. The problem isn’t mismanagement by the farmer; it’s a system where farmers shoulder the risks while corporations reap the rewards. Whether small or large, farms of every size are being squeezed by fertilizer giants with the power to dictate prices and profits.

Taxpayers Foot the Bill

When fertilizer giants drive up input costs, it’s not just farmers who are on the hook—taxpayers are, too. To keep farms afloat, the federal government has repeatedly stepped in with massive bailout programs funded by taxpayers. In just the past year, there have already been two major bailouts, with a third on the horizon. While fertilizer corporations pad their margins, everyday Americans end up footing the bill.

Policy Failures and Growing Consolidation

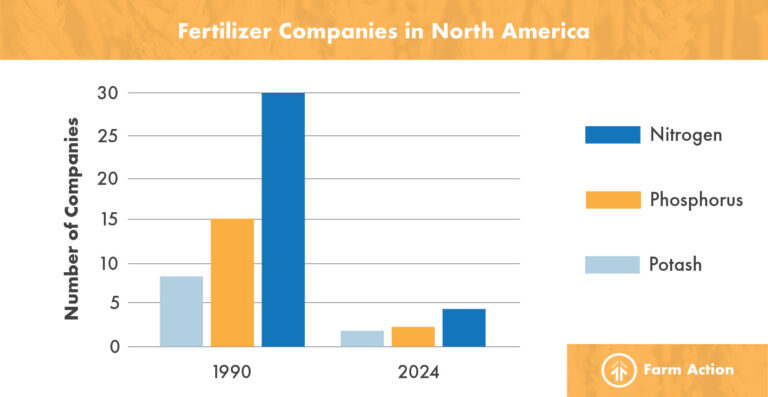

This chokehold didn’t happen by accident. Decades of lax antitrust enforcement allowed mega-mergers to consolidate fertilizer companies into just a few global players, and the problem is only getting worse.

Take the recent acquisition of the Iowa Fertilizer Company—a plant built with taxpayer support in 2017 and touted as a new, independent competitor to corporate fertilizer giants. Just six years later, Koch Industries—the very company the plant was meant to compete against—acquired it.

The problem wasn’t just one bad deal. It’s a symptom of a policy system rigged to favor consolidation. Without safeguards to prevent large corporations from swallowing smaller competitors, even well-intentioned public investments only serve to expand monopoly control. And once again, the revolving door between agribusiness and government ensured that regulators looked the other way.

Breaking the Fertilizer Monopoly

The fertilizer sector is a case study in how concentrated corporate power extracts wealth from farmers and consumers while destabilizing the food system. But it doesn’t have to stay this way. Stronger antitrust enforcement, fair trade policies, and investments in regional fertilizer production could help break the stranglehold of the Big Three. Increasing support for regenerative methods that promote soil health and reduce reliance on synthetic fertilizers would also help farmers break free from the industrial agriculture treadmill.

Farm Action is working to expose how fertilizer giants manipulate markets and to push for policies that restore fairness and resilience to our food system. Farmers shouldn’t be trapped by three corporations when it comes to something as essential as growing food.

This post, like the rest of our Food Monopoly Files series, draws from Kings Over the Necessaries of Life, our landmark investigation into how monopoly power reshaped U.S. agriculture. Next up, we’ll look at how two machinery giants control the farm equipment market—and why a $500,000 combine you can’t fix yourself isn’t innovation, it’s extortion.