Farm Action Applauds Food Supply Chain Executive Order, Urges Swift Action by New Task Forces

Farm Action welcomes the administration’s move to crack down on price fixing and anticompetitive behavior in our food and agriculture system.

Farm Action welcomes the administration’s move to crack down on price fixing and anticompetitive behavior in our food and agriculture system.

The Department of Justice’s investigation is a welcome first step. But if policymakers are serious about standing up to abusive corporate power, they must go beyond an inquiry.

“Ranchers need fair prices. Consumers deserve honesty at the checkout. It’s time to fix this broken system once and for all,” said Farm Action’s Angela Huffman.

We exposed corporate price gouging in the egg industry, leading to federal investigations, proposed legislation, and lower egg prices for families.

Farm Action released a statement and informational memo in reaction to USDA’s latest Egg Markets Overview report and the recent decline in egg prices.

Farm Action’s letter to FTC and DOJ lays out new evidence on how the highly concentrated egg industry is ripe for manipulation by the dominant egg firms at the expense of both consumers and smaller egg producers.

Farm Action’s letter to FTC and DOJ lays out new evidence on how the highly concentrated egg industry is ripe for manipulation by the dominant egg firms at the expense of both consumers and smaller egg producers.

The industry narrative is that pork prices are up in California because of higher production costs to meet Prop. 12’s crate-free requirement, but this is not supported by the data.

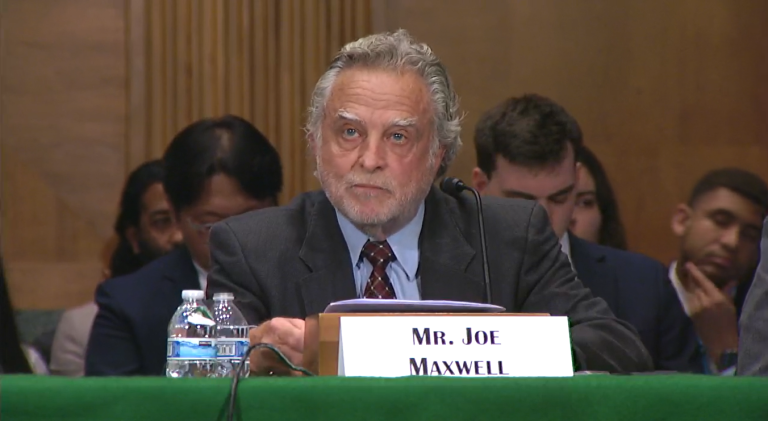

Farm Action’s Joe Maxwell will draw from the organization’s research to call for the U.S. government to crack down on corporate price gouging.

FTC’s report found that the largest grocers took advantage of supply chain disruptions during the pandemic to raise prices on consumers.