What Is Price Fixing?

Whether you’re buying food to put on your table or fertilizer for your farm, you probably assume that the prices are based on supply and demand — not an agreement among competitors. When competitors agree to raise, lower, maintain, or stabilize prices together, this is called “price fixing,” and it is illegal.

Price fixing is a symptom of extreme consolidation, so it doesn’t come as a surprise that the meatpacking industry — in which just four corporations control 85% of beef and 70% of pork — is racking up allegations. Consolidation leaves corporations free to work together: Fewer market players makes coordination easier, allowing a few dominant corporations to push up consumer prices and drive down farmers’ share of the consumer dollar — under the guise of various “market disruptors,” such as the pandemic and nebulous supply chain issues.

Meatpackers Are Having Their Cake And Eating It, Too

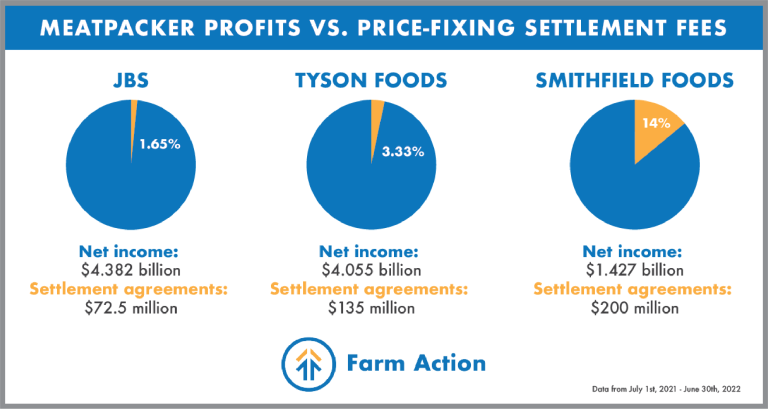

In case after case, meatpackers pay a pittance in price-fixing lawsuit settlements compared to the record profits they make off these pricing schemes. The situation has gotten so bad that even the nation’s largest food distributor got tired of getting ripped off and sued Big Meat over alleged price fixing. But these lawsuits are meaningless if meatpackers can simply settle for a tiny fraction of the profits they’re making.

Brazilian meatpacking behemoth JBS reported a $4.382 billion net income for Fiscal Year 2022 ending on June 30th (FY 2022) — a 56% increase year-over-year. Meanwhile, the corporation agreed to pay $72.5 million between two price-fixing settlements since the beginning of FY 2022. To put this into perspective, this is like someone who is making $43,820 a year off of a crooked market deal and only paying $725 back as a penalty for their actions. It’s only 1.65% of their gain — no more than a spit in the ocean.

The American-owned Tyson Foods’ reported net income for FY 2022 was $4.055 billion — a whopping 72.85% increase year-over-year. Tyson agreed to pay $135 million between four price-fixing settlements since the beginning of FY 2022, costing them less than 3.33% of their annual gains generated from potentially conducting illegal practices.

Smithfield Foods no longer publicly discloses its profits after Chinese-owned WH Group purchased the company; however, WH Group’s reported net income was $1.427 billion for the year ending in June 2022 — an 18.86% increase year-over-year. The corporation agreed to pay $200 million between three price-fixing settlements since the beginning of FY 2022**, costing them only 14% of their profit for the year. Let’s just call these settlements what they are: the cost of doing business.

Corporations are Cheating Consumers and Farmers

These record profits are not generated out of thin air. That money comes directly out of the pockets of consumers and farmers, with lawsuits cropping up all over alleging that these price-fixing schemes are costing consumers millions of dollars in overpayments. All the while, farmers’ share of the consumer dollar continues to drop. Since 1970, the producer’s share of the consumer beef dollar has plummeted from around 70% to 37%. Corporations take it all off the backs of everyone else, then boast about record profits in their annual reports.

Why Do Corporations Keep Getting Away With This?

While we have antitrust laws in place to prevent price fixing and to hold companies who engage in it accountable, the DOJ has repeatedly failed to secure convictions because it is simply outgunned by meatpacking monopolies. While penalties for price fixing can include up to 10 years of imprisonment and fines of up to $100 million, corporate leaders are almost never sent to prison, and these fines alone are clearly not a deterrent.

How Can We Better Hold Corporations Accountable?

Currently, corporations can treat price-fixing settlements as annual operating costs. A critical step to rein in this corporate market abuse is to strengthen the Packers and Stockyards Act to protect farmers and crack down on anticompetitive practices. Additionally, passing the Competitive Prices Act would protect consumers by making it easier to prosecute antitrust violations in civil cases and close a loophole that allows companies in the same market to inflate consumer prices in tandem with one another.

We must also ensure that those found guilty of price fixing face criminal convictions. While imprisoning executives for financial crimes may seem inconceivable, it’s been done before: More than 1,000 bankers were convicted by the Department of Justice following the Savings and Loan Crisis of the late 1980s. It’s time to bring about serious consequences for corporations and their executives that cheat our consumers and farmers.

*Profit data was collected from the following reports to calculate FY 2022: 2021 Annual Report, 2021 Interim Report, 2022 Interim Report.

**Smithfield agreed to settle a price-fixing lawsuit for $83 million on June 29, 2021 — two days before the start of FY 2022.

We included this in our settlement total.

Written and edited by Jessica Cusworth, Dee Laninga, Cathy Cowan Becker, Angela Huffman, and Joe Maxwell